CRM Software Pricing Comparison: A Comprehensive Guide opens the door to a world where every business, regardless of size or ambition, is faced with the challenge of choosing the ideal customer relationship management solution. Like explorers navigating a labyrinth of options, decision makers find themselves weighing costs, features, and hidden variables, seeking a path that leads to efficiency and growth. Each decision point is more than a number—it’s a step toward shaping the future of customer engagement and business success.

Understanding the intricate landscape of CRM pricing is essential before taking the plunge. From diverse pricing models—subscription-based, one-time licenses, freemium plans, and tiered packages—to the nuanced features and add-ons that can reshape your budget, the journey is filled with opportunities and potential pitfalls. This guide illuminates the factors that influence cost, reveals how different business sizes are affected, and uncovers the hidden fees and negotiation tips that make all the difference in finding your perfect CRM match.

Introduction to CRM Software Pricing

Understanding the pricing of Customer Relationship Management (CRM) software is fundamental for organizations aiming to optimize their customer engagement strategies while achieving cost efficiency. Pricing models differ significantly across the industry, with each structure influencing the short- and long-term financial commitments required by businesses. A clear comprehension of these pricing frameworks and the variables driving them allows decision-makers to align their CRM investment with operational objectives and budget constraints.

Evaluating CRM software pricing involves more than simply comparing numbers; it requires a systematic analysis of both explicit and hidden costs, including licensing, implementation, training, and ongoing support. The market offers a spectrum of pricing models, each designed to cater to diverse business scales, functional requirements, and deployment preferences. Recognizing these differences is essential for making an informed purchase decision that avoids unforeseen expenses and maximizes return on investment.

Overview of Common CRM Pricing Models

CRM software vendors employ several pricing models tailored to different organizational needs. Each model presents distinct cost structures and scalability implications, influencing organizational adoption and total cost of ownership.

- Subscription-based (SaaS) Pricing: Most modern CRM solutions, such as Salesforce and HubSpot, operate on a Software-as-a-Service (SaaS) model. This involves a recurring monthly or annual fee, typically charged per user. The subscription fee often covers software updates, maintenance, and cloud hosting, making it accessible for businesses with varying IT resources.

- Perpetual Licensing: Some CRM vendors offer perpetual licenses, where organizations pay a one-time fee for software ownership, usually accompanied by optional annual maintenance and support contracts. This model is more common in on-premises deployments and may involve higher upfront investments but lower long-term recurring costs.

- Freemium and Tiered Pricing: Platforms like Zoho CRM and Freshsales offer free entry-level plans with essential functionalities, while advanced features are accessible through paid tiers. Tiered pricing allows businesses to scale usage and feature sets as their needs evolve, providing cost predictability and customization.

- Usage-based Pricing: Some CRM providers, especially those integrating with communication tools or analytics, apply usage-based fees. This model charges based on resources consumed, such as API calls, contacts stored, or emails sent.

Key Factors Influencing CRM Software Prices

CRM software pricing is shaped by a variety of factors that impact both initial acquisition and ongoing operational expenses. Recognizing these determinants aids organizations in forecasting total investment and aligning it with their strategic goals.

- Number of Users: Most SaaS CRM platforms price their services on a per-user basis. As organizations scale their teams, the cost per month or year rises proportionally, making user count a critical variable in budgeting.

- Feature Set and Customization: Advanced capabilities such as workflow automation, AI-driven analytics, and marketing automation typically incur higher charges. Custom modules and industry-specific adaptations can also increase overall costs.

- Deployment Type: On-premises CRMs often require a substantial upfront capital outlay for software licensing and hardware, whereas cloud-based solutions distribute costs over time via subscriptions. This influences both cash flow and IT resource allocation.

- Integration and Add-ons: Integrating CRM systems with other business software (e.g., ERP, email marketing tools) or adding premium plugins can result in additional expenses. Vendors may charge extra for API access or third-party integrations.

- Implementation and Training: Successful CRM adoption frequently involves professional services for data migration, configuration, and end-user training. The complexity of these tasks can significantly impact the total investment required.

“A comprehensive analysis of CRM software pricing should factor in direct expenses, such as licensing fees, and indirect costs like staff training, integration, and ongoing support, to accurately assess the true cost of ownership.”

Types of CRM Pricing Models: CRM Software Pricing Comparison: A Comprehensive Guide

Understanding the pricing models used by CRM software vendors is essential for organizations aiming to make informed decisions that align with their operational scale, budget constraints, and strategic objectives. CRM pricing structures directly impact long-term costs, feature accessibility, and scalability, making an analytical comparison vital for both small businesses and large enterprises.

Each pricing model reflects a vendor’s approach to monetizing their platform and meets different market requirements. By examining these models, stakeholders can better anticipate expenses, plan for future growth, and ensure that their chosen CRM solution delivers desired value.

Overview of Main CRM Pricing Structures

CRM vendors employ several distinct pricing strategies, each with unique mechanisms and typical use patterns. Choosing the right pricing model often depends on organizational priorities such as flexibility, total cost of ownership, feature depth, and user volume.

The most prevalent CRM pricing models include:

- Subscription-based pricing

- One-time license fee

- Freemium model

- Tiered pricing structures

The appropriateness of a CRM pricing model is determined not only by upfront costs but also by long-term functionality, support, and scalability implications.

Detailed Comparison of CRM Pricing Models

The following table provides a structured comparison of the main CRM pricing models, including a description, well-known vendors exemplifying each approach, and typical scenarios in which each model is most effective.

| Model Type | Description | Example Vendors | Typical Use Case |

|---|---|---|---|

| Subscription-Based | Clients pay a recurring fee (monthly or annually) for access to the software, often delivered as a cloud-based service (SaaS). | Salesforce, HubSpot, Zoho CRM | Organizations seeking predictable, manageable operational expenses with regular updates and minimal infrastructure investment. |

| One-Time License | A single, upfront payment grants perpetual use of the software, typically hosted on-premises, sometimes with optional support fees. | Microsoft Dynamics 365 (on-premises), Act! | Enterprises desiring complete data control, minimal recurring costs, and customizability in secure environments. |

| Freemium | Basic features are available for free, with paid upgrades unlocking advanced functionality, integrations, or support. | Freshsales, Bitrix24, Agile CRM | Startups or small teams needing core CRM tools without immediate financial commitment, with room to scale as needs grow. |

| Tiered Pricing | Multiple plans offered at increasing price points, with each tier containing additional features, users, or support levels. | Pipedrive, Insightly, Copper | Businesses with scalable requirements and the need to align costs with evolving usage or feature demands. |

Analytical Insights on CRM Pricing Selection

Choosing a CRM pricing model requires a thorough analysis of both immediate and long-term business needs. Subscription-based models are often preferred by organizations prioritizing agility and ease of deployment, whereas one-time licenses may appeal to those aiming for capital investment and maximum control. Freemium models support experimentation and initial adoption, especially for budget-conscious users or rapidly evolving teams. Tiered pricing strikes a balance, allowing organizations to pay only for what they need while maintaining a clear path to advanced capabilities as requirements expand.

In practice, many vendors blend these models or offer hybrid approaches to address varied market segments. For instance, Salesforce is primarily subscription-based but incorporates tiered pricing for different feature sets, while HubSpot’s freemium entry point evolves into paid tiers as customer needs mature.

A sound understanding of CRM pricing structures enables organizations to forecast costs, negotiate terms, and select solutions that optimize both short-term and long-term value.

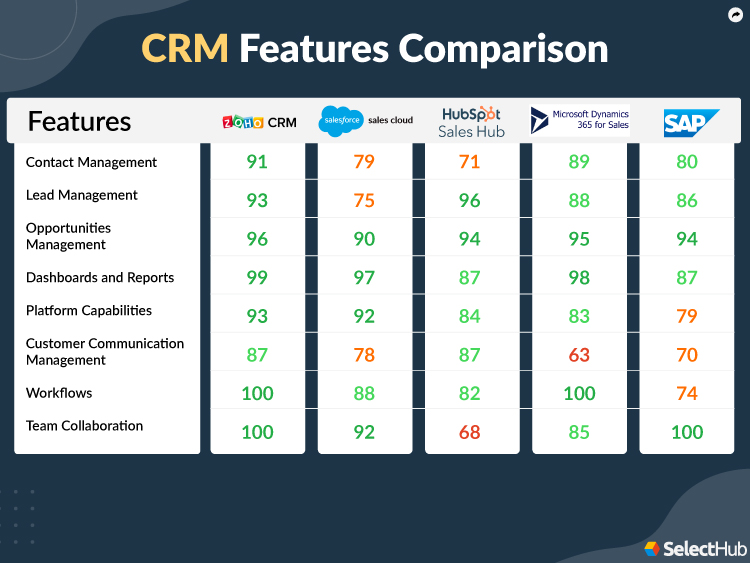

Key Features Affecting CRM Costs

CRM software solutions vary widely in pricing, largely due to the breadth and sophistication of features included in each offering. Understanding which features are fundamental and which are considered premium is critical for organizations seeking to align CRM investments with specific business requirements and budgetary constraints. The selection of features directly influences both upfront and ongoing expenses, shaping the total cost of ownership.

The complexity of a CRM’s architecture, the depth of its automation capabilities, and the integration options it provides can cause significant cost differentials between platforms. Furthermore, as businesses scale or demand deeper system customization, pricing structures often reflect increased resource consumption, support requirements, and development overhead, contributing to higher expenditures over time.

Core Functionalities Impacting CRM Pricing

Fundamental CRM features are typically included in most entry-level packages, yet the depth and flexibility of these features can affect costs. For example, a basic contact management system maintains simple customer records, while advanced versions offer real-time data enrichment, interaction tracking, and extensive segmentation capabilities, which are often priced at a premium.

The following table illustrates how core features may impact the overall CRM pricing structure:

| Feature | Description | Impact on Pricing |

|---|---|---|

| Contact Management | Organizes customer and lead information, enabling tracking and updating of records. | Basic in entry-level; advanced search, segmentation, and custom fields incur extra costs. |

| Workflow Automation | Automates repetitive tasks such as lead assignment, email scheduling, and reminders. | Included in higher-tier plans, with advanced automation (e.g., multi-step processes) raising costs. |

| Reporting & Analytics | Provides dashboards and customizable reports on sales, marketing, and service metrics. | Enhanced analytics and real-time reporting typically in premium tiers or as add-ons. |

| Third-Party Integrations | Connectivity with external tools (e.g., email, ERP, marketing automation, social media). | Native integrations may be included, but API access, advanced connectors, and marketplace apps often require additional fees. |

“The inclusion of advanced automation, analytics, and integration features can increase CRM subscription costs by 30% to 70% compared to basic packages, based on a 2023 market analysis by G2 and Software Advice.”

Premium Features and Add-Ons Associated with Higher Pricing

CRM vendors often segment their plans by offering select advanced capabilities only at higher price points or as separate modules. These premium features address specialized needs and introduce significant value, but also contribute to cost escalations.

Premium features that frequently increase CRM software costs include:

- Artificial Intelligence (AI) and Machine Learning (ML) for predictive sales insights, lead scoring, and automated next-best-action recommendations.

- Advanced marketing automation tools, such as multi-channel campaign management and behavior-based segmentation.

- Customizable dashboards and deep analytics, including pipeline forecasting and cohort analysis.

- Industry-specific modules (e.g., healthcare compliance, financial services workflows) tailored to regulatory or operational requirements.

- Enhanced security options with advanced user permissions, audit logging, and single sign-on (SSO) integration.

- Dedicated mobile application functionality with offline access and device management.

- Premium support packages, such as 24/7 live assistance, dedicated account managers, or priority escalation.

These add-ons present clear advantages for complex organizations or niche verticals, but their costs may represent a substantial proportion of the total CRM investment, particularly when licensed per user or per functional module.

Influence of Customization and Scalability on CRM Pricing Structures

The capacity for customization and scalability is a pivotal driver of CRM pricing—especially for organizations with unique workflows or rapid growth trajectories. Customization refers to the ability to tailor the CRM’s fields, workflows, and interfaces to match specific business processes, while scalability addresses the platform’s capability to support increasing data volumes and user counts without performance degradation.

When a CRM system offers advanced customization, such as custom objects, scripting, and API extensibility, vendors often apply additional charges due to the complexity of implementation, ongoing maintenance, and technical support. Furthermore, scalability—particularly the ability to add users, storage, or features seamlessly—usually involves tiered pricing. For instance, Salesforce and Microsoft Dynamics 365 provide entry-level plans for small teams, but costs escalate as businesses require more users, higher storage limits, and advanced modules.

The following illustrates how customization and scalability manifest in CRM pricing:

- Custom development or bespoke integrations may incur setup fees, hourly developer rates, or increased subscription costs.

- Growing user bases typically result in per-user subscription models, where unit prices may decrease with volume but total costs scale rapidly.

- Data storage and API call limits may require customers to purchase incremental capacity as their usage expands.

- Organizations with global operations or complex hierarchies might require multi-entity support or localization features, often provided only in enterprise plans.

In summary, both customization and scalability not only ensure the CRM system fits evolving organizational needs but also lead to higher and more variable pricing as the solution adapts alongside the business.

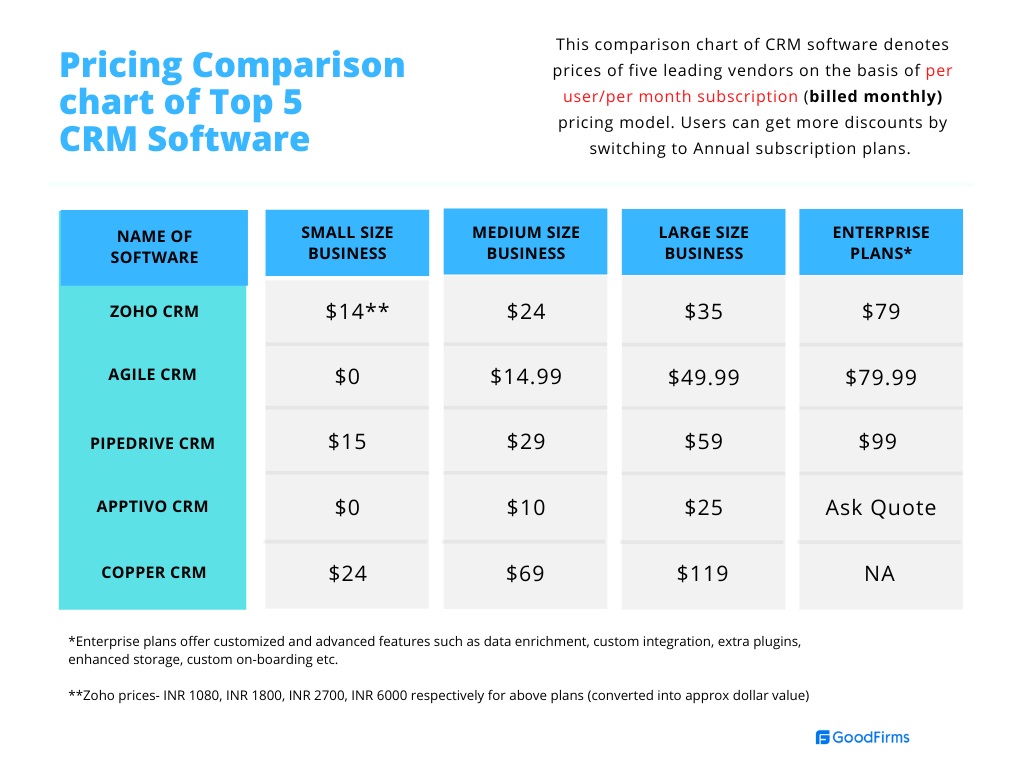

CRM Software Pricing Comparison Table

Selecting the most suitable CRM software for your organization involves careful evaluation of both financial investment and expected value. The CRM market features a range of solutions tailored to businesses of varying sizes and needs, with significant differences in starting prices, feature sets, and licensing approaches. Effective comparison enables decision-makers to align CRM capabilities with their operational requirements and budgetary constraints.

A thorough pricing comparison table provides essential insights for organizations aiming to maximize their software investment. By analyzing notable features, free trial options, and the balance of cost-to-value, businesses can make informed choices that deliver measurable productivity gains and return on investment.

Detailed Comparison of Leading CRM Solutions, CRM Software Pricing Comparison: A Comprehensive Guide

The following table highlights four prominent CRM platforms—Salesforce Sales Cloud, HubSpot CRM, Zoho CRM, and Pipedrive—using standardized criteria. Columns include CRM Name, Starting Price (per user/month), Notable Features, Free Trial Availability, and a succinct summary of the cost-to-value ratio.

| CRM Name | Starting Price (per user/month) | Notable Features | Free Trial Availability | Cost-to-Value Ratio |

|---|---|---|---|---|

| Salesforce Sales Cloud | $25 |

|

30 days |

|

| HubSpot CRM | Free (core features); Paid plans from $18 |

|

14 days (for paid plans) |

|

| Zoho CRM | $14 |

|

15 days |

|

| Pipedrive | $14.90 |

|

14 days |

|

When interpreting this data, organizations should weigh not only the initial subscription costs but also the breadth of features accessible at each tier and potential scalability. For example, Salesforce’s premium is offset by its enterprise-grade flexibility, while HubSpot’s zero-cost entry point can accommodate rapid expansion with subsequent investments in advanced capabilities.

Descriptive illustration: Imagine a visual representation where each CRM’s name is accompanied by a bar, the length corresponding to its starting price. Additional icons overlay these bars to denote distinguishing features such as “free trial,” “AI integration,” or “custom workflow.” This visualization quickly communicates both relative costs and feature highlights, supporting faster preliminary comparisons for stakeholders.

Additional Costs and Hidden Fees

The base subscription price of CRM software often covers core features, but organizations frequently encounter additional costs that can significantly increase the total cost of ownership. Understanding and accounting for these potential expenses is crucial for budgeting and informed decision-making. These extra charges may arise from initial setup requirements, premium features, integration demands, user training, and ongoing support. Careful scrutiny of vendor agreements helps prevent unforeseen financial burdens and ensures that the chosen CRM system remains cost-effective over time.

Common Sources of Extra Charges in CRM Implementations

While evaluating CRM solutions, buyers must recognize that many vendors use a tiered pricing strategy with essential functions included in the advertised package. However, several operational necessities may fall outside the quoted price. Knowing where such extra costs typically emerge helps organizations control expenses and avoid unwelcome surprises.

- Setup and Implementation Fees: Many vendors charge a one-time onboarding or implementation fee, which covers the initial configuration, customization, and data migration. For instance, Salesforce implementations can range from a few hundred to several thousand dollars depending on complexity.

- Training Costs: Standard platform training may not be included, and custom training sessions for team members can incur additional charges. For example, HubSpot offers paid training workshops for advanced users.

- Premium Support Charges: Basic customer support is often included, but priority or 24/7 support typically entails extra fees, sometimes as a monthly per-user surcharge.

- Integration and API Access: Connecting the CRM to other business tools or using advanced APIs can result in extra fees. For example, Zoho CRM charges for premium integration connectors and advanced API limits.

- Storage and Data Overages: Exceeding allocated storage (contacts, attachments, or emails) may trigger overage charges. Microsoft Dynamics 365, for instance, applies additional rates when storage limits are surpassed.

Practical Examples and Identification of Hidden Fees in Vendor Contracts

Hidden fees often lurk in areas not immediately apparent during the initial pricing discussion. They may be embedded in the contract’s fine print or arise from evolving usage patterns as the CRM system is adopted and scaled. Recognizing these charges requires detailed contract analysis and targeted questioning during vendor evaluation.

- Long-Term Commitment Penalties: Some CRM vendors provide attractive introductory rates but impose steep renewal or cancellation penalties if clients terminate early or reduce their user count.

- Feature Gating: Critical features like automation, analytics, or advanced reporting may be reserved for higher-tier plans, leading to unforeseen upgrades if initial functionality is insufficient.

- User License Inflation: Some platforms require a minimum number of users or charge in increments, not per individual, causing buyers to pay for unused licenses.

- Mandatory Upgrades: Compliance or security updates may necessitate purchasing additional modules or services, often flagged as “optional” but practically essential.

“Careful review of the Master Service Agreement and pricing appendix is essential to identify not only visible costs but also conditional fees that may be triggered by future business growth or technology changes.”

Examining real-world scenarios, a mid-sized retail company implemented a leading CRM platform that appeared cost-effective at $50 per user/month. After six months, the total monthly invoice doubled due to charges for advanced analytics, premium support, and extra storage—none of which were highlighted in the initial sales presentation but detailed in the contract’s addendum. This illustrates the importance of scrutinizing all documentation and asking vendors to clarify terms before signing.

Comparing Pricing for Small, Midsize, and Enterprise Businesses

CRM software pricing structures are highly sensitive to the size and complexity of the business adopting the solution. Variations in user count, required features, integration needs, and support expectations drive substantial differences in total cost of ownership across small, midsize, and enterprise organizations. Understanding these distinctions is essential for organizations aiming to align their CRM budget with operational needs and future scalability.

CRM vendors typically segment their pricing and feature sets according to business size, offering tiered packages to suit the demands and capacities of each market segment. While small businesses often focus on cost-effectiveness and ease of use, midsize companies require more customizability and automation, and enterprises demand advanced analytics, robust integrations, and high-level security.

CRM Pricing and Considerations Across Business Sizes

The choice of CRM should be informed not only by immediate budgetary constraints but also by the strategic trajectory of the organization. The table below delineates how CRM pricing and offerings differ for small, midsize, and enterprise businesses, highlighting representative solutions and key purchasing considerations.

| Business Size | Typical Price Range (USD/user/month) | Recommended CRM Solutions | Key Considerations |

|---|---|---|---|

| Small Business | $12–$30 | Zoho CRM, HubSpot CRM (Starter/Free), Freshsales, Pipedrive |

|

| Midsize Business | $25–$75 | Salesforce Sales Cloud (Professional/Enterprise), Microsoft Dynamics 365 Sales, Insightly, Zoho CRM (Professional/Enterprise) |

|

| Enterprise | $75–$200+ | Salesforce Sales Cloud (Enterprise/Unlimited), SAP Sales Cloud, Oracle CX, Microsoft Dynamics 365 (Enterprise) |

|

“CRM scalability is not only about the ability to add more users, but also about supporting increased data complexity, regulatory compliance, and advanced reporting as organizations grow.”

Scalability and Limitation Issues by Business Size

Selecting a CRM system must address current needs while anticipating future requirements. The scalability of a CRM is dictated by its architecture, licensing model, and the vendor’s product roadmap. Each business size faces distinct challenges as detailed below.

- Small businesses typically encounter limitations in feature sets as their needs evolve, often outgrowing entry-level plans that lack robust automation, pipeline customization, or external integrations. For example, a growing e-commerce startup using a basic HubSpot plan may soon need advanced marketing automation or multi-channel sales support, necessitating an upgrade or migration.

- Midsize organizations must consider the overhead of switching costs if their chosen CRM cannot scale efficiently. Expansions in team size or new departmental requirements may reveal gaps in workflow automation or reporting, as seen in mid-market financial services companies that quickly surpass the limits of non-enterprise licenses like Zoho Professional.

- Enterprises face the complexity of integrating CRM with multiple data sources, legacy platforms, and compliance frameworks. The challenge is not just the higher cost per user, but also the need for extensive customization and rigorous change management, as evidenced by large-scale Salesforce or SAP implementations in multinational corporations. Delays, hidden costs, and the risk of vendor lock-in become more pronounced at this scale.

The strategic evaluation of CRM solutions should thus incorporate not just initial pricing, but also the incremental cost and operational friction associated with scaling up along with the business lifecycle.

Cost-Benefit Analysis of CRM Investment

A rigorous cost-benefit analysis is essential to determine whether a CRM software investment will generate tangible business value over time. By quantifying both the direct and indirect costs as well as measuring the resulting benefits, organizations can make informed decisions regarding CRM adoption or upgrades. This section details proven approaches for estimating return on investment (ROI), calculating total cost of ownership (TCO), and illustrates scenarios demonstrating measurable business impact from CRM deployments.

Return on Investment Evaluation for CRM Systems

Evaluating the ROI of CRM solutions involves comparing the financial gains derived from CRM-driven process improvements and revenue growth against the overall investment cost. Effective ROI analysis typically considers both short-term and long-term benefits, including increases in sales, improvements in customer retention, reductions in operational costs, and enhancements in employee productivity.

The standard formula used to calculate CRM ROI is:

ROI = [(Total Benefits – Total Costs) / Total Costs] × 100%

Total benefits may encompass increased sales, higher customer lifetime value, and cost savings from automation. Total costs include license/subscription fees, implementation expenses, training, and ongoing support.

Total Cost of Ownership Assessment

A comprehensive understanding of TCO enables businesses to anticipate all direct and indirect costs over the CRM system’s lifecycle. TCO encompasses not only upfront software expenses but also integration costs, customization, user training, maintenance, and potential upgrade fees.

The following table Artikels the main elements contributing to the TCO of a CRM solution:

| Cost Component | Description | Typical Frequency |

|---|---|---|

| License or Subscription Fees | Recurring payments for CRM access (per user/per month or annual) | Ongoing |

| Deployment and Implementation | Costs for setup, customization, and initial data migration | One-time (initial) |

| Integration | Connecting CRM with other enterprise systems (ERP, marketing, etc.) | One-time, with potential future updates |

| Training | User and administrator training to ensure adoption and efficacy | Initial and periodic (for new features/users) |

| Support and Maintenance | Technical support, troubleshooting, software updates, and system upkeep | Ongoing |

| Upgrade and Scalability | Costs for feature expansion, adding users, or system upgrades | As needed |

Understanding these components ensures organizations are not blindsided by hidden or future expenses as the CRM environment evolves.

Scenarios Demonstrating Business Improvements from CRM Adoption

Practical examples provide valuable insights into the real-world impact of CRM investments. The following scenarios illustrate how various businesses have benefited from CRM implementations:

- Retail Sector – Increased Sales Conversion: A mid-sized retail chain integrated a cloud-based CRM to streamline customer data management and personalize marketing campaigns. Within the first year, the company reported a 20% increase in sales conversion rates and a 15% reduction in customer attrition, directly attributed to targeted communications and improved follow-up.

- B2B Services – Enhanced Productivity: A professional services firm deployed a CRM platform to centralize client interactions, automate scheduling, and provide real-time analytics. This led to a 25% reduction in administrative workload and enabled consultants to allocate more time to client-facing activities, ultimately boosting overall billable hours.

- Manufacturing – Improved Forecast Accuracy: A manufacturing company implemented CRM analytics modules to better track leads, orders, and customer service requests. As a result, sales forecast accuracy improved by 30%, allowing for more efficient inventory planning and reduced excess stock.

Each scenario demonstrates how CRM adoption can yield quantifiable benefits, justifying the initial and ongoing investment through measurable business outcomes such as increased revenue, improved operational efficiency, and enhanced decision-making capabilities.

Tips for Negotiating CRM Pricing and Getting the Best Deal

Securing an optimal pricing structure for CRM software requires not only a thorough understanding of listed costs, but also a strategic approach to negotiation. Vendors often have flexibility in their pricing and contract terms, especially when approached with careful preparation and awareness of market standards. Effective negotiation can result in significant cost savings, additional features, and more favorable contractual terms over the lifecycle of your CRM deployment.

Understanding the factors that influence negotiation dynamics, such as deal size, competitive alternatives, and the vendor’s sales cycles, empowers buyers to leverage their position. Employing a structured negotiation strategy can also reveal hidden opportunities for discounts, beneficial licensing arrangements, and value-added services.

Key Strategies for Negotiating with CRM Vendors

A systematic approach to negotiating CRM software deals ensures that organizations maximize value and minimize unnecessary expenditure. The following points elaborate on actionable steps and proven methods to achieve advantageous outcomes in CRM pricing discussions.

Before entering any negotiation, it is vital to assess your requirements, market options, and the specific levers that can sway vendor decisions.

- Conduct Market Research and Benchmarking: Gather up-to-date pricing data from multiple CRM vendors to establish benchmarks. Use industry surveys, comparison sites, and customer forums to identify standard rates and common discount levels.

- Define Non-Negotiable Requirements: Clearly Artikel essential features, user counts, integration needs, and support levels. This clarity helps in resisting upselling and focusing negotiations on what truly matters to your business.

- Request Customized Proposals: Ask vendors for tailored quotes based on your actual usage scenarios. This often uncovers more relevant pricing structures and custom discounts.

- Leverage Competitive Offers: Share (when appropriate) competing quotes with vendors. Most leading CRM providers are willing to match or beat competitor pricing to secure a deal.

- Negotiate Contract Flexibility: Prioritize terms such as opt-out clauses, scalability options, and free trial periods, which can mitigate long-term risks and costs as your business evolves.

Approaches for Securing Discounts and Value-Adds

Beyond basic negotiation, several practical tactics consistently lead to direct cost reductions or added service value. These methods exploit common vendor policies designed to incentivize larger or longer-term deals.

Discount opportunities typically arise from bundling, pre-paying, or aligning with vendor sales objectives.

- Bundle Features or Product Suites: Vendors often provide significant price breaks for purchasing multiple modules or services together, such as combining CRM, marketing automation, and customer support tools.

- Commit to Annual or Multi-Year Billing: Opting for yearly or multi-year contracts frequently yields discounts ranging from 10% to 25% compared to monthly billing cycles, as evidenced by pricing policies from Salesforce, HubSpot, and Zoho CRM.

- Negotiate Volume Licenses: If your organization requires a large number of user seats, pursue volume discounts. For example, Microsoft Dynamics 365 and Salesforce both offer tiered reductions for organizations exceeding certain user thresholds.

- Request Non-Profit, Start-Up, or Educational Rates: Many CRM vendors provide special pricing programs for non-profits, early-stage businesses, and educational institutions, often resulting in discounts of 30% or more.

- Ask for Free Onboarding or Training Services: Instead of monetary discounts, some vendors are willing to include complimentary implementation support, user training sessions, or data migration services, which can reduce total cost of ownership.

Effective negotiation involves not just price reduction, but optimizing the total value delivered through favorable terms, added features, and minimized hidden charges.

Timing and Relationship Management in CRM Negotiations

Vendor willingness to negotiate often fluctuates based on timing and the nature of the business relationship. Recognizing these patterns can lead to more favorable deals.

The following considerations help optimize negotiation outcomes based on timing and engagement strategy.

- Engage Near Quarter or Fiscal Year-End: Vendors often have sales quotas and are more likely to approve discounts near the end of reporting periods to close deals.

- Build a Collaborative Relationship: Establishing rapport and transparency with vendor representatives increases trust and can lead to better support and pricing flexibility.

- Be Prepared to Walk Away: Demonstrating willingness to delay or abandon the deal gives buyers more leverage, especially when alternative CRM options are available.

Illustrative Example of Negotiation Outcome

A mid-sized e-commerce business seeking to deploy a CRM for 100 users approached three top vendors: Salesforce, Zoho CRM, and Microsoft Dynamics 365. By presenting current quotes from each provider, committing to a two-year agreement, and requesting bundled onboarding services, the business secured a 20% reduction from Salesforce’s initial list price, received an additional 10% discount from Zoho based on user volume, and gained free implementation support from Microsoft Dynamics 365—demonstrating the tangible impact of strategic negotiation and comparison.

Current Trends Influencing CRM Software Pricing

Recent years have witnessed significant evolution in the CRM software landscape, driven by technological advancements and shifting business needs. This has directly impacted pricing structures, feature offerings, and value perception among customers. Three of the most influential trends shaping CRM pricing are the integration of AI-powered features, enhanced support for remote workforces, and the proliferation of vertical-specific solutions. These trends not only reflect changing customer expectations but also drive vendors to adapt their models and offerings to remain competitive and relevant.

AI-Powered Features and Their Pricing Implications

The integration of artificial intelligence (AI) into CRM platforms has transformed the industry standard. AI capabilities—such as predictive lead scoring, intelligent automation, chatbot-driven support, and advanced analytics—have rapidly shifted from optional add-ons to expected core functionalities. Vendors invest heavily in research and infrastructure to deliver these capabilities, resulting in both tiered pricing and new premium service categories.

- AI-enhanced analytics and automation are often available only in mid- to high-tier plans or as separate paid modules.

- Some CRM providers, such as Salesforce and HubSpot, have introduced surcharges or seat-based pricing specifically for users requiring AI-driven tools.

- Increased data usage from AI features leads to higher costs for data storage and processing, which vendors pass on to customers via metered billing or usage-based tiers.

“AI-driven features are now a key differentiator, and customers expect demonstrable ROI, prompting vendors to justify higher price points.”

Remote Work Integration and Collaborative Functionality Pricing

With the global shift toward hybrid and fully remote work environments, CRM vendors have prioritized collaboration tools, seamless integration with communication platforms, and mobile accessibility. These enhancements, once considered supplementary, are now incorporated into core pricing structures, reshaping how features are bundled and monetized.

- CRMs such as Zoho and Monday.com have launched specialized remote work modules, often integrated into higher subscription tiers or as optional add-ons.

- Increased demand for third-party integrations (e.g., Slack, Zoom, Microsoft Teams) has led some vendors to charge additional fees for API access or advanced integration capabilities.

- Licensing structures have evolved to account for distributed teams, with more granular seat pricing and flexible user management options.

Vendors that provide robust remote work features often justify premium pricing by highlighting increased productivity, data security, and compliance support tailored for remote operations.

Vertical-Specific Solutions and Tiered Pricing Strategies

A growing number of CRM vendors are developing industry-tailored solutions—such as CRMs for real estate, healthcare, legal, and financial services—to address unique sector requirements. This trend has reshaped pricing by introducing higher-value packages bundled with specialized features, compliance tools, and sector-specific integrations.

- Vendors like Veeva (life sciences) and Propertybase (real estate) offer sector-focused CRMs with custom modules, resulting in bespoke pricing often above standard CRM rates.

- Vertical solutions typically include regulatory compliance, industry templates, and prebuilt workflows, allowing vendors to claim higher per-user or per-company fees.

- Industry-specific support, onboarding, and consulting services are frequently packaged into subscription tiers, shifting CRM pricing from simple software licensing to solution-based models.

“Vertical-specific CRMs command premium pricing due to their tailored value, exclusive integrations, and compliance-readiness—creating a segmented pricing landscape.”

These evolving trends collectively shape not only what customers expect from CRM solutions but also how vendors structure pricing and position their offerings in a competitive, innovation-driven market.

Concluding Remarks

As the curtain falls on our exploration of CRM Software Pricing Comparison: A Comprehensive Guide, remember that choosing the right system is more than a financial decision; it’s a strategic leap toward lasting relationships and scalable growth. By uncovering the true costs, weighing the benefits, and navigating vendor strategies, your business stands poised to transform investment into measurable impact and forge ahead with confidence in a fiercely competitive world.

Essential FAQs

What is the most affordable CRM software for startups?

Many startups begin with freemium or low-cost subscription CRM solutions like HubSpot or Zoho CRM, which offer basic features at little to no cost with the flexibility to scale as the company grows.

Are there any hidden costs in CRM software contracts?

Yes, hidden costs can include setup fees, data migration, premium integrations, advanced support, or even mandatory training sessions. Always review contracts carefully and ask vendors about all potential charges.

How do annual and monthly billing options affect CRM pricing?

Annual billing often offers a discounted rate compared to monthly payments. Committing to annual plans can yield significant savings, but may reduce flexibility if your needs change mid-year.

Is it possible to negotiate CRM pricing with vendors?

Yes, many vendors are open to negotiation, particularly for larger contracts or longer commitments. Strategies include bundling features, requesting discounts for upfront payments, or leveraging competitor quotes.

What features should I prioritize to maximize CRM ROI?

Focus on features that directly support your business goals, such as automation, integration with existing tools, scalability, and robust reporting. Avoid paying for advanced add-ons you won’t immediately use.